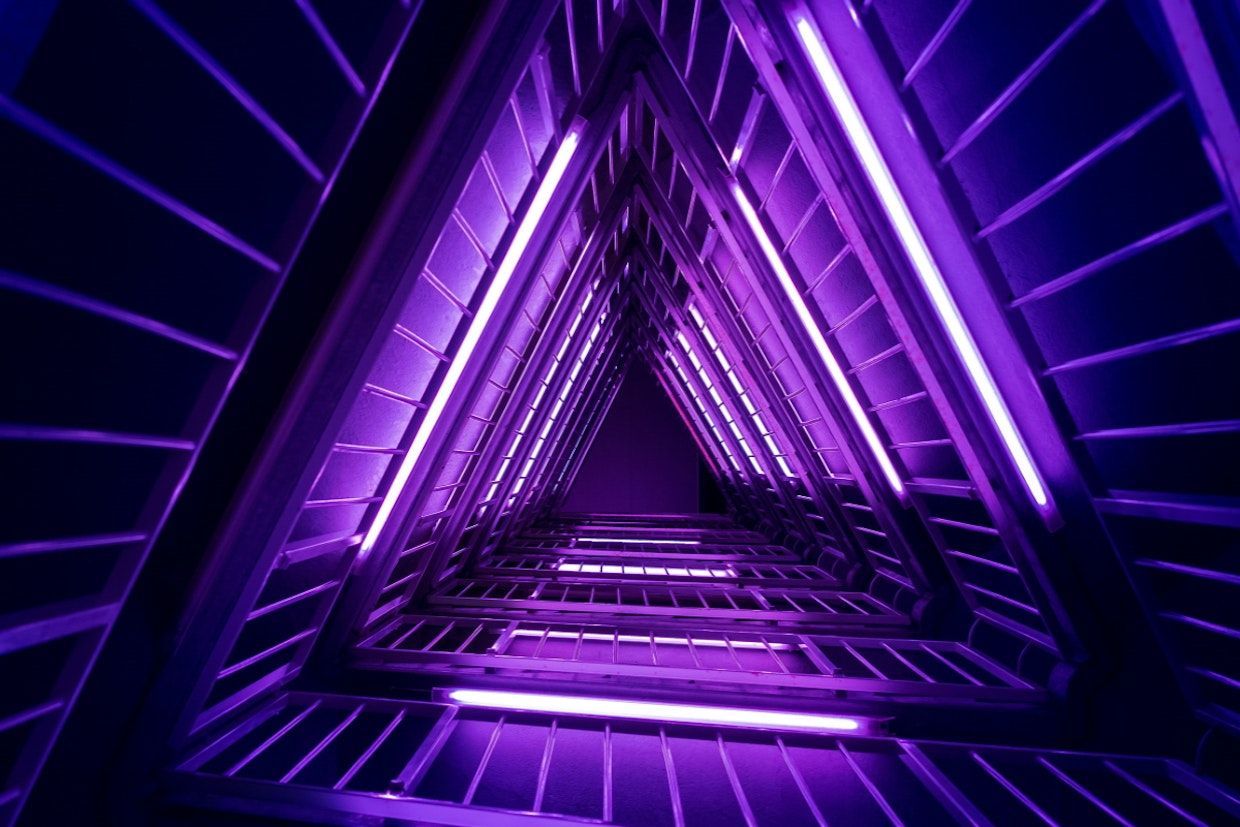

The Project Management Triangle: Quickly, Cheaply, or Done Well - Pick Two!

Every project manager has heard the saying: "You can have it done quickly, cheaply, or well - pick two." This timeless concept is known as the Project Management Triangle, or the Iron Triangle. At its core, it reflects the delicate balancing act between three constraints: time, cost, and quality.

The Triangle forces us to confront reality: perfection across all three is impossible. Let’s unpack this concept and explore how understanding the trade-offs can help you make better project decisions.

The Three Points of the Triangle

Quickly (Time)

Time is the driving factor when deadlines loom large. When speed is a priority, you’ll likely need to compromise on cost or quality. Faster timelines often require more resources - such as hiring additional help - or cutting corners to save time.

Example: Releasing a new service before a competitor. You might launch on time, but processes could still need refinement.

Cheaply (Cost)

Budget-conscious projects aim to keep costs low, but this can stretch timelines or reduce quality. Limited funding often means fewer resources or less experienced workers, which can lead to delays and subpar results.

Example: Opting for an affordable tool that meets basic needs but lacks the customisation to work seamlessly for your team.

Well (Quality)

High-quality projects produce reliable and robust outcomes, but they demand both time and money. Quality requires skilled professionals, thorough planning, and attention to detail - all of which come at a cost.

Example: Implementing a comprehensive software solution like a new accounting or stock management system. Done properly, it transforms your business, but the process won’t be cheap or fast.

The Trade-Offs: You Can Only Pick Two

The Triangle teaches us that something must give. Let’s explore what happens when you prioritise two points at the expense of the third:

Quickly + Cheaply = Not Well

Speed and affordability rarely result in high quality. This combination often leads to errors, rework, or an end product that doesn’t fully meet your needs.

Quickly + Well = Not Cheap

High-quality results on a short timeline require significant investment. You’ll need to hire top talent, work overtime, or pay for premium services to deliver both speed and quality.

Well + Cheaply = Not Quickly

Prioritising quality on a tight budget takes time. With limited resources, progress is slower, but the outcome will meet your standards.

Using the Triangle to Make Smarter Decisions

The Project Management Triangle isn’t just a theoretical concept—it’s a practical tool for setting expectations and making informed decisions. When kicking off a project, consider these steps:

Identify Priorities

Ask yourself (and your team): What matters most? Is it meeting a deadline, staying within budget, or achieving top-notch results? Ranking these factors helps guide your decisions.

Communicate Clearly

Use the Triangle to frame discussions with stakeholders. Explaining the trade-offs can prevent unrealistic expectations and keep everyone on the same page.

Plan Accordingly

Once priorities are set, allocate resources to align with them. If speed and quality are key, invest in experienced professionals. If cost is the focus, plan for longer timelines or simpler deliverables.

Why It Matters

Ignoring the Triangle often leads to frustration, budget blowouts, or rushed results. Embracing it, however, helps you set realistic goals, build trust with stakeholders, and deliver projects that meet the most critical needs.

The next time someone insists on having it all—fast, cheap, and perfect—pause and ask: "Which two matter most?" It’s not about settling; it’s about making choices that serve the project’s ultimate goals.