If I’m working ON my business what should I be doing?

I’m sure you’ve heard about the need to work ‘on’ your business as well as working ‘in’ your business. But have you ever stopped to think what exactly you should be doing?

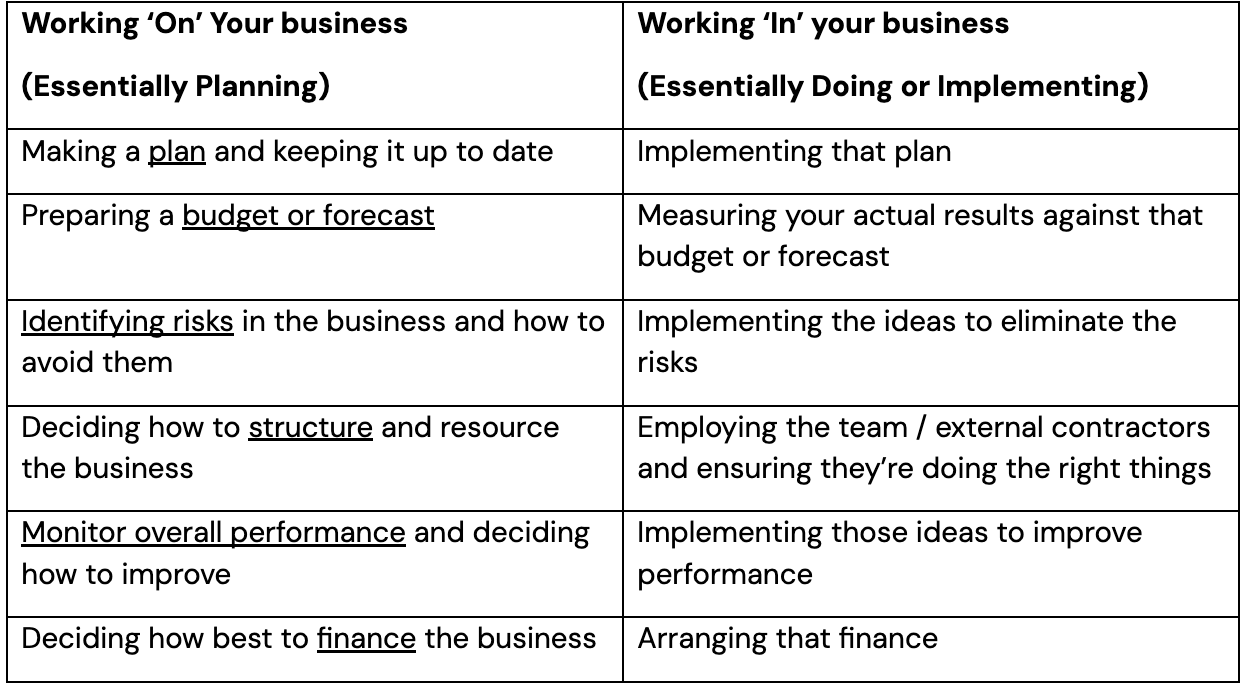

First some practical distinctions to compare working ‘on’ and working ‘in’.

With the above in mind here are the 5 most important activities you should do:

- Prepare a business plan and update it annually – do this in the last month of your financial year or the first month of the new financial year

- Prepare a budget and forecast for the upcoming 12 months at the same time as you prepare your plan (and of course review this annually too)

- Report against that plan and budget monthly

- Communicate the plan and the results to the owners and team

- Meet monthly for 1 to 2 hours to review your progress, your numbers, your business structure and any risks and opportunities that exist to improve the business

Working on the business is by no means a full-time role – you should be able to do this effectively with 1 to 2 hours per week, ½ a day per month (to review the information and then have an effective monthly meeting) and then 1 to 2 days off-site every year to update the plan and structure.

Best practice is to get someone independent of your business to help you establish and maintain these regular disciplines and hold you to account to really improve your business.

What do you need to change to work more effectively ‘on’ your business?

The business is there to serve you; not the other way round. You should not be a slave to your business - Anon