Tax E-News

LEGISLATION DAY 2025 - WHAT WAS PUBLISHED?

On ‘Legislation Day’ (21 July 2025), HM Treasury released a range of draft legislation and tax documents. The key measures to be implemented by the new legislation can be categorised into the following areas:

CLOSING THE TAX GAP

Several measures are proposed that will target tax avoidance. In addition, tax agents will be required to register with HMRC in order to deal with HMRC on their customers’ behalf. One of HMRC’s main reasons for introducing Making Tax Digital (MTD) for Income Tax is that it will supposedly reduce errors. MTD is covered in more detail in the article below.

PUTTING THE TAX SYSTEM ON A FAIRER, MORE SUSTAINABLE FOOTING

Key measures in this category include:

- The controversial restrictions on the amounts of inheritance tax relief available for agricultural and business property from April 2026 (see below);

- Proposals to include inherited pension pots in a deceased person’s estate for inheritance tax purposes from April 2027; and

- Proposals to bring Employee Car Ownership Schemes into scope of the benefit in kind rules as company cars.

MAINTAINING THE TAX SYSTEM

Key measures in this category include:

- A proposal to introduce an easement that will help to mitigate the significant increase in benefit in kind (BiK) for plug-in hybrid electric vehicles (PHEVs) following a potential introduction of the new Euro 6e standard. If the standard is introduced in Great Britain, it would significantly increase the BiK tax due on PHEV company cars, which is linked to CO2 emissions.

- Technical guidance that aims to provide clarity on the tax implications of PISCES. PISCES stands for “Private Intermittent Securities and Capital Exchange System”, which is a new type of stock market that will allow private companies to have their shares traded intermittently.

HMRC’S TRANSFORMATION ROADMAP

On 21 July 2025, HMRC launched their Transformation Roadmap, which sets out ambitious plans for HMRC to become a digital-first organisation by 2030, with 90% of customer interactions taking place digitally. This compares to 76% as at today. HMRC will automate tax wherever possible and offer new digital self-serve options across a number of tax regimes.

It is estimated that the plans will save HMRC £50 million a year, including by moving customer letters and reminders to a digital-first approach and reducing the reliance on paper correspondence by 2028/29. Paper post provision will remain for critical correspondence and for the digitally excluded.

The Transformation Roadmap sets out timescales for delivery and HMRC is committed to reporting on progress. Work is underway to deliver some of the measures set out in the roadmap this tax year, including:

- Improving Self Assessment registration service and streamlining the exit process for those customers who no longer need to file a Self Assessment tax return.

- A new service to give employed parents, who are newly liable for the High Income Child Benefit Charge, the choice to pay it directly through their tax code without needing to register for Self Assessment.

- Launching an enhanced reward scheme for informants, targeting information on serious non‑compliance in large corporates, wealthy individuals, offshore and avoidance schemes.

Longer-term improvements include:

- From April 2026, the pre-population of Self Assessment tax returns with Child Benefit data.

- From 2027-28, digitising the inheritance tax service.

- Simplifying payments and refunds, including direct bank repayments and easier National Insurance contribution refunds.

- Single Customer Account Programme to provide a unified view of the taxpayer's overall income and tax position in their digital account.

Lastly, in what will come as good news to many, HMRC announced that MTD for Corporation Tax will not be implemented.

MAKING TAX DIGITAL - WHAT’S NEW?

HMRC are pushing ahead with the implementation of Making Tax Digital (MTD) for Income Tax, set to commence from 6 April 2026. Legislation Day saw the publication of draft MTD legislation, which makes the following recently-announced changes to the planned regime:

- More individuals will be exempt from MTD – Ministers of religion, Lloyds underwriters, recipients of Blind Persons’ Allowance and donors of Power of Attorney.

- Certain kinds of income will be outside the scope of the MTD rules, namely Qualifying Care Income (e.g. foster care income) and the UK earnings of non-resident entertainers and sportspeople who have no other sources of income caught by the MTD rules.

- The requirement to use MTD-compatible software to file the individual’s year end tax return.

- A new concept introduced in the draft MTD Regulations is ‘latency’, which is the term being used for the concept of a newly-commenced trade or property business not being subject to the MTD rules until 6 April following the tax year in which a filing obligation arose for the tax year of commencement. As an example, if a trader is mandated into MTD in 2026/27 because of her property income, then starts a new trade in December 2026, 2027/28 is the year in which the filing obligation (31 January 2028) arises for the year of commencement and she will need to start complying with MTD rules for the new trade from 6 April 2028.

If you are an individual who receives income from a trade or property business, you are likely to be mandated at some point over the next few years if your combined sales from property businesses and self employment (‘qualifying income’) exceeds £20,000. The first group of individuals to be mandated, from 6 April 2026, will be those who had qualifying income in excess of £50,000 in the 2024/25 tax year.

Being mandated into MTD for Income Tax will mean that you need to keep your trade and property business records in MTD-compatible software and use the software to send quarterly summaries to HMRC. The changes mentioned above are relatively minor - the key requirements of MTD for Income Tax have not changed.

PROPOSED CHANGES TO INHERITANCE TAX

As announced at Autumn Budget 2024, the government has published draft legislation to reform Agricultural Property Relief (APR) and Business Property Relief (BPR) from 6 April 2026 to make them “fairer and more sustainable”

In addition to existing nil-rate bands and exemptions, APR and BPR will continue, but a cap will be introduced that will restrict the 100% relief to the first £1 million of combined agricultural and business property. The rate of relief will be 50% thereafter.

Relief will also be reduced to 50% (with no £1m allowance) for quoted shares designated as “not listed” on the markets of recognised stock exchanges, such as AIM. The changes will take effect from April 2026.

In inevitable disappointment to business owners and farming communities, no significant changes have been made to these plans since the Autumn Budget 2024 announcement.

The government has, however, announced that it will not proceed with the proposed extension of the related property rules for qualifying property settled into multiple trusts.

It has also been announced that:

- The option to pay IHT by equal annual instalments over 10 years interest-free will be extended to all property which is eligible for agricultural property relief or business property relief.

- The £1 million allowance for agricultural property relief and business property relief will be indexed in line with CPI, but will remain fixed up to and including tax year 2029/30 in line with maintaining the IHT nil rate bands at current thresholds.

CLASS 2 NICs - 2024/25 ERRORS

HMRC have identified an issue affecting some Self Assessment taxpayers in relation to Class 2 National Insurance contributions (NICs) for 2024/25. Some self-employed taxpayers with profits above £12,570 have seen a Class 2 NICs charge of £358.80 added to their accounts when they shouldn’t have been. In some circumstances it will be less.

HMRC say that they have taken action to correct the Class 2 NICs figure where the information they hold has allowed. If this applies to you, you will have received a message to let you know.

HMRC will correct the records of other taxpayers after the issue has been resolved and will notify them once this has been done. Taxpayers will be issued with a new SA302 tax calculation after their record has been corrected.

The issue seems to have been caused by reforms to NICs that took effect from 2024/25. Self employed taxpayers and partnership members no longer have to pay Class 2 NICs - if their profits are over the small profits threshold (£6,725 for 2024/25), Class 2 NIC is treated as having being paid.

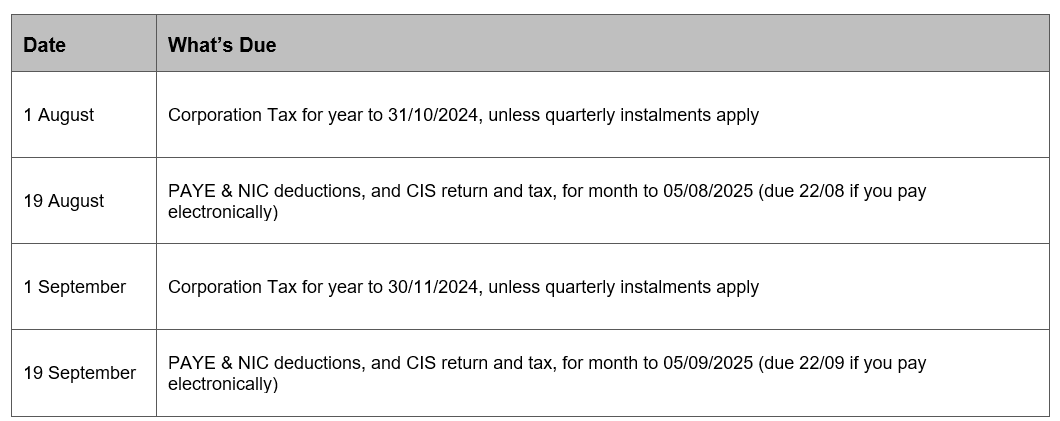

DIARY OF MAIN TAX EVENTS

AUGUST / SEPTEMBER 2025