Business credit: the importance of a good business credit score

Access to additional funds is what allows you to invest in your business and grow the company. But to be able to borrow from lenders it’s vital to have a good business credit score. So, what is a business credit score and how is it calculated? And what proactive action can you take to improve your all-important credit profile

What’s a business credit score?

Your company’s business credit score is a measurement of your creditworthiness as a company. In other words, it gauges how risky you are to lend to, based on factors like your credit history, payment history, cashflow position and publicly available information like your accounts.

A low score means you’re classed as high risk. A high score means you’re low risk.

Who gives the scores and what do they mean?

Credit scores are calculated by the major credit reporting agencies (CRAs). These are agencies that collate financial data and information to make informed assessments of your risk rating.

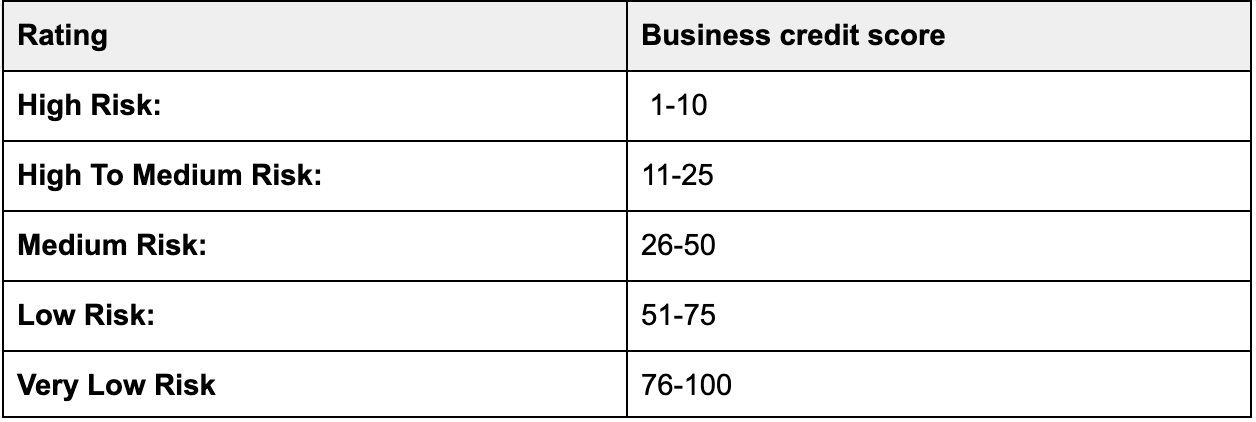

Each CRA uses slightly different metrics and scoring scales, with some using a 0 to 100 scale, some a 0 to 1000 scale and some a 0 to 300 scale. But the Experian scale of 0-100 is one of the most commonly used.

Key ways to improve your credit score

If you fall into the high-risk category, you’ll find accessing finance – like bank overdrafts, business loans or asset finance – extremely difficult.

If you fall into the medium-to-low risk categories, access to finance will be much easier.

To increase your ability to borrow money and access credit, it’s important to be proactive about managing and improving your business credit score.

Here are five ways to boost your credit score:

Pay your suppliers and bills on time

Make sure you always pay invoices from suppliers, utility companies and other creditors on or before their due date. This shows your financial management is reliable and responsible – a key factor in building a positive business credit history with the CRAs.

Keep your credit utilisation low

If your business has existing credit facilities, aim to use only a small portion of the available credit limit. High credit utilisation can have a negative impact on your score, and suggests a high state of ‘financial distress’ to potential lenders and credit providers.

Establish trade credit with your suppliers

Agree on trade credit terms with your suppliers and make sure you settle the bills on time. These payment histories are often reported to credit bureaus and can be a significant factor in building up a positive business credit profile, especially for newer enterprises.

Monitor your business credit report regularly

Obtain copies of your business credit report from relevant agencies (like Equifax or Illion in Australia) to check for inaccuracies or errors. Addressing any negative information promptly can prevent it from further harming your credit score.

Avoid defaults and public record filings

Minimize the risk of defaults on loans or other financial obligations, and be mindful of public record filings like court judgments or bankruptcies. These events can severely damage your business credit score and make future borrowing difficult.

Get in touch to talk about your business credit score

There are plenty of options for checking your business credit score and getting a solid overview of your credit profile as a business.

Talk to the team about signing up for regular credit reports and how we can help you monitor and manage your credit score.