Knowing the tax impact of using a company car

Having the use of a company car is a great perk. But are you aware of the tax impact of a company car and how having this vehicle may affect your company benefits?

Two of the key tax considerations related to company cars are the benefits in kind (BIK) tax charges incurred by the driver, and the tax deductions which benefit the company. At present, it’s also worth understanding the benefits of running an electric or low-emission vehicle.

Understanding the BIK charges on your company car

The BIK amount you’re taxed on as the driver of a company car is calculated as a percentage of the list price of the vehicle when new. The list price includes delivery charges, optional extras and VAT but not the registration fee or the first year’s vehicle excise duty.

Because it’s based on the original ‘list price when new’ value, any discounts are ignored, and even for used cars, the original value is retained.

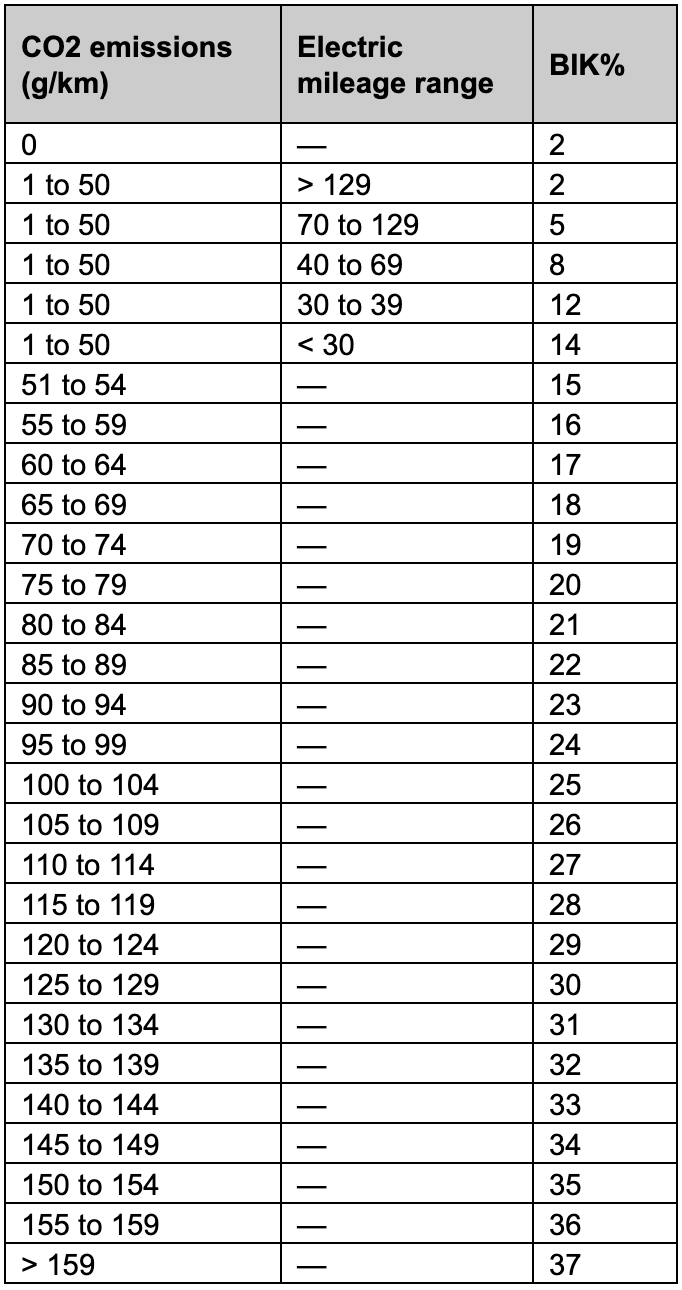

The percentage applied depends on CO2 emissions, and for hybrid vehicles the on-electric range, as you can see in the table below:

It’s worth noting that:

- Diesel vehicles registered before January 2021 that aren't RDE2-compliant attract a 4% surcharge on their published BIK rate, up to a maximum total of 37%

- Where fuel is provided by the company for private mileage, the same percentage is applied to a value of £27,800.

Claiming company benefits against the cost of a company car

Although the driver is taxed on the perk of driving a company car, the company can benefit by claiming deductions for the costs involved in running this vehicle.

All expenses in connection with the operation and maintenance of the car are deductible as trading expenses, including things such as insurance, fuel and maintenance.

Capital allowances are also available in respect of the purchase price of the vehicle.

Depending on the vehicle, the capital allowances available are:

- 100% First Year Allowance – this is only for new zero-emission cars.

- 18% annual allowance on written-down value – this is for second-hand electric vehicles and all vehicles with emissions between 1 and 50 g/km

- 6% annual allowance on written-down value for all other new and used vehicles.

Talk to us about the tax implications of company cars

If you’re thinking about investing in a company car, it’s worth considering that there are tax advantages for both the company and the driver in selecting an all-electric vehicle. There are also advantages, to a lesser extent, in opting for a low-emission vehicle.

We can calculate the likely personal BIK tax charge on any vehicle you’re considering buying through your business, as well as advising on the tax and other implications for the company.

Talk to us before purchasing a company car for personal use. The tax charges can be higher than you may expect, so it’s worth considering the BIK impact before you buy.

Get in touch for a chat about your company car plans.