How will inheritance tax changes affect your farming business?

If you’re involved in UK farming, the recent changes to inheritance tax (IHT) won’t have escaped your notice. There have been protests from the farming community and big questions about how these IHT amendments will affect the industry.

But what are these IHT changes? And is your farming business likely to be affected?

What are the main changes to IHT for farming businesses?

The Chancellor, Rachel Reeves, announced reforms to agricultural property relief (APR) and business property relief (BPR) from inheritance tax in the Autumn Budget 2024.

Currently, your farming business can make use of APR and BPR at a rate of 100% or 50%, with no cap on the total amount of relief for businesses that meet the eligibility criteria.

The big change is that inheritance tax relief for business and for agricultural assets will be capped at £1m from April 2026. There will be a new reduced rate of 20% charged above that £1m threshold, instead of the usual inheritance tax rate of 40%.

The tax will be payable in instalments over 10 years, interest free, with the government aiming to supply a technical consultation by early 2025 and the reforms coming in from April 2026.

Who will actually be affected by the new £1m threshold?

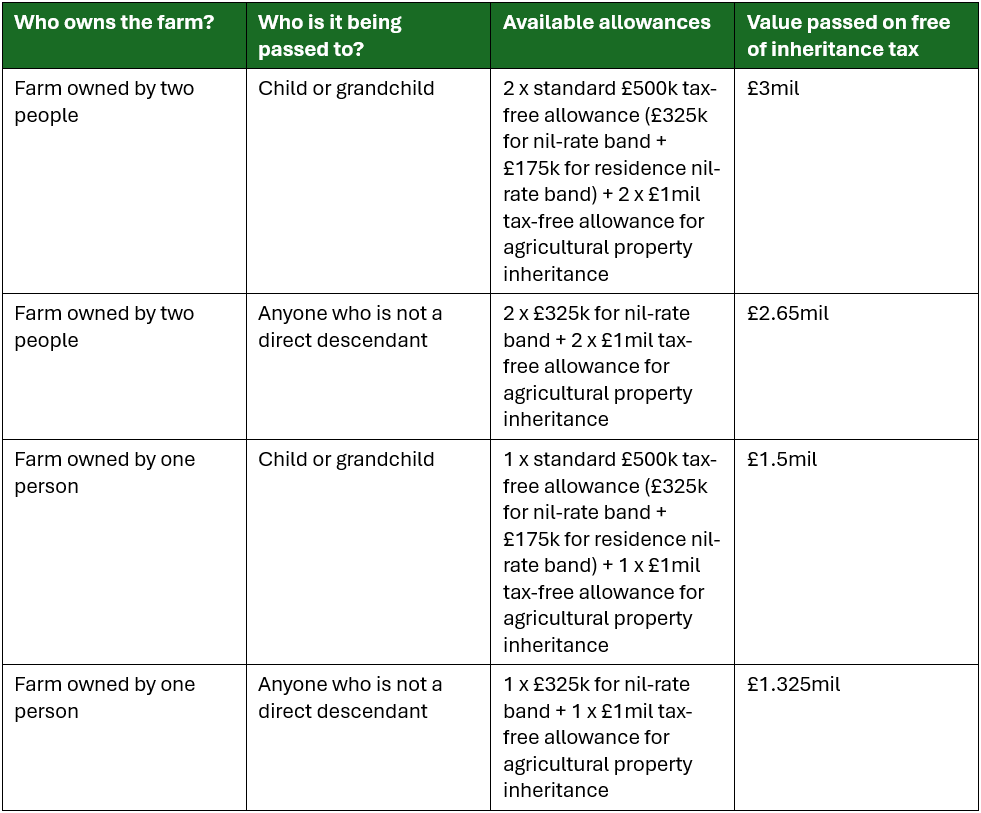

If you’re wondering how you’re likely to be affected by the new £1m threshold, and the impact it will have on your succession planning, HMRC has provided a helpful table.

Talk to us about preparing for these IHT changes

If your farming business falls below the £1m threshold, you’ll be able to continue claiming the APR and BPR reliefs as usual. If the value of your business is over the threshold then now’s the time to assess the impact and to take appropriate tax-planning measures.

Come and talk to the team and see what steps you can take to minimise the impact.