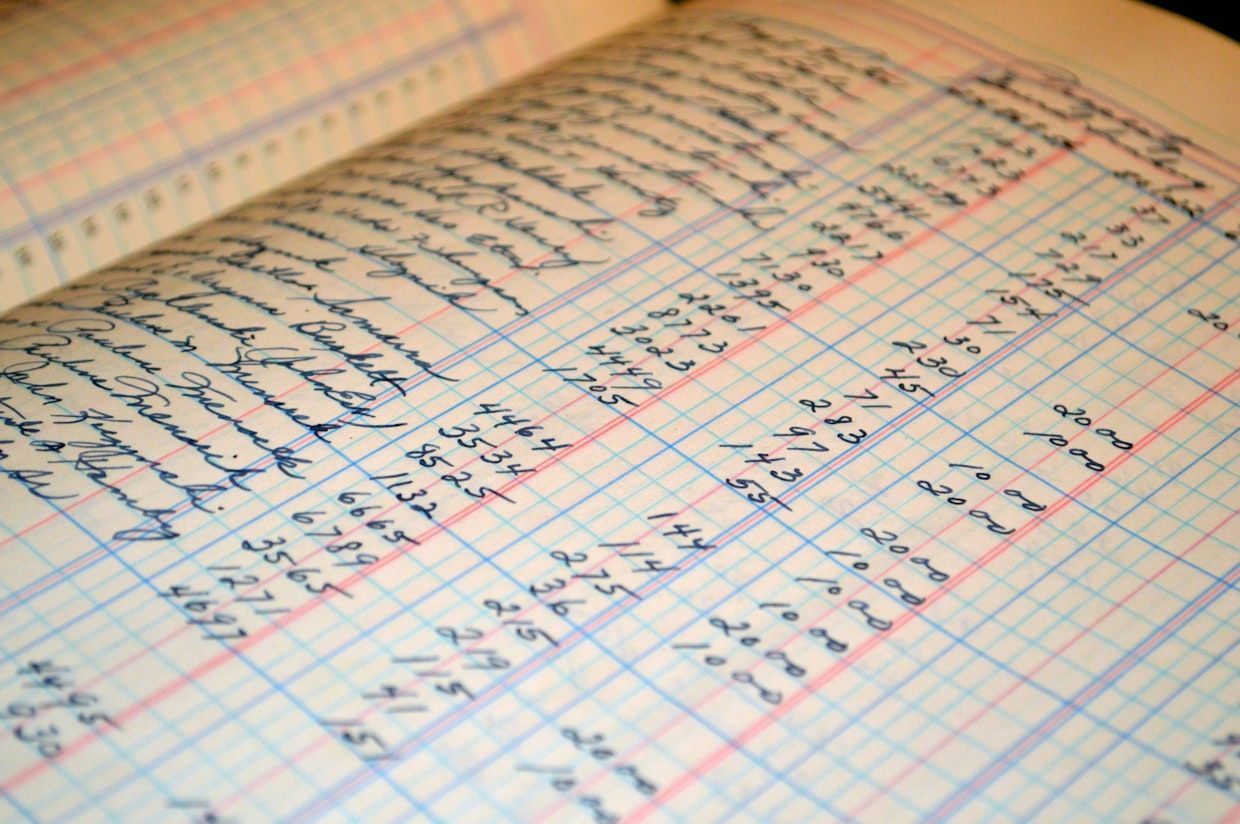

DIY accounting vs hiring an accountant: make the right choice for your business

When you’re starting out as a small business owner, the temptation is to go DIY with your accounting. Hiring a professional accountant or tax adviser costs money and that’s an overhead that you can remove by doing all the financial management yourself, right?

But is DIY accounting the most sensible option for your business? And why might partnering with an experienced accountant be a valuable investment in your future?

The 5 big challenges of managing your own accounts

At the initial stages of founding your business, you might think that raising a few invoices, paying a few supplier bills and making sure there’s cash in the bank is well within your abilities.

However, as the business grows, and you take on more customers and employees, your finances are likely to get far more complicated – not to mention far more time-consuming. So, should you still be managing your accounts solo at this important stage of your growth?

Here are five of the common challenges of going down the DIY accounting route:

- The knowledge gap – grasping the finer points of accounting principles and tax regulations is complex. If you try to navigate these financial complexities without the right knowledge and experience, you greatly increase the risk of errors, missed deductions, poor record-keeping and non-compliance with company tax law for your territory.

- The drain on your time – Managing bookkeeping, payroll, day-to-day accounting and tax filings takes a lot of time out of your week. For example, recent stats show that Aussie business owners spend an average of 6 hours and 19 minutes per week on financial administration. If you’re spending a large chunk of your week working on finance admin, that’s time you’re NOT spending on growing the business. As an ambitious owner, you should be concentrating on business development and the other strategic tasks that will push your growth – not doing the books!

- Staying up to date with the regulations – Company tax laws and accounting regulations change frequently. If you’re not on the ball with the latest regulatory changes, there’s every chance that you’ll fail to meet your compliance duties. And, you may also miss out on the latest government incentives and tax reliefs too – financial perks that could well be the key to funding the next stage in your business expansion plans.

- Anxiety about a company audit – going through a company audit from an external auditor can be stressful. Depending on the status of your business, you may well have to comply with the rules for regular auditing. But with no accountant, your record-keeping may be haphazard, making the job more difficult, time-consuming and disruptive.

- A lack of strategic insight – If you’ve never run a business before, it’s likely you’ll lack the awareness of how good financial management drives your strategic insight. The better your accounts, the higher the quality of your finance data, reporting and management information. And this data and reporting can be a goldmine of information when making big strategic decisions, setting budgets and forecasting cashflow etc.

How working with an accountant turns these challenges into business benefits

Having full responsibility for your own business finances is a major drain on your time as an owner and business leader. But the good news is that partnering with an accountant can very quickly lighten this load and get you back to focusing on your business.

By engaging an accountant to take on your financial management, you get:

- The knowledge of an experienced finance professional – when you hire an accountant, you add a financial expert to your team. They'll help you navigate the complexity of accounting, will keep your records accurate and will make sure you comply with all relevant tax regulations. This minimises errors and maximises your deductions.

- More time to focus on the business – by delegating your bookkeeping, payroll, accounting and tax filings to an accountant, you free up valuable time. This gives you more time in the day to talk to customers, develop growth strategies and build relationships with clients, partners, lenders and investors.

- Stay ahead of the regulatory curve – a professional accountant knows exactly which legislative and regulatory changes are planned and will make sure you’re always ticking the right compliance boxes. They’ll also be aware of any new government tax deductions or funding incentives that may open up extra cash for your business plans.

- Peace of mind when it comes to an audit – with an accountant managing your accounts, you can rest assured that you have the best possible record-keeping, reporting and financial compliance. This is a major bonus when you face an external audit process. Your accountant can even represent you during the audit process, cutting down the potential stress and keeping you focused on running the business.

- Expert strategic guidance – accountants do way more than just crunching numbers. Your accountant will work with you to analyse your financial data, manage your cashflow, identify patterns and trends and provide the valuable insights you need to inform your decision-making. An accountant is a key part of your management and strategic team, helping you drive the success, efficiency and profitability of your business.

Talk to us about outsourcing your financial management

Hiring a great accountant is definitely a better investment in your business than opting for DIY accounting. Instead of getting bogged down in bookkeeping, or going red in the face with record-keeping, just hand over the financial management workload to the experts.

We’re here to lighten the load, sort out your accounts and put you back in complete control of your finances and strategic decision-making.

Get in touch to discuss taking on your accounting tasks