Where are you on your business journey?

STARTING YOUR BUSINESS

Content to add if needed

RUNNING YOUR BUSINESS

Content to add if needed

GROWING YOUR BUSINESS

Content to add if needed

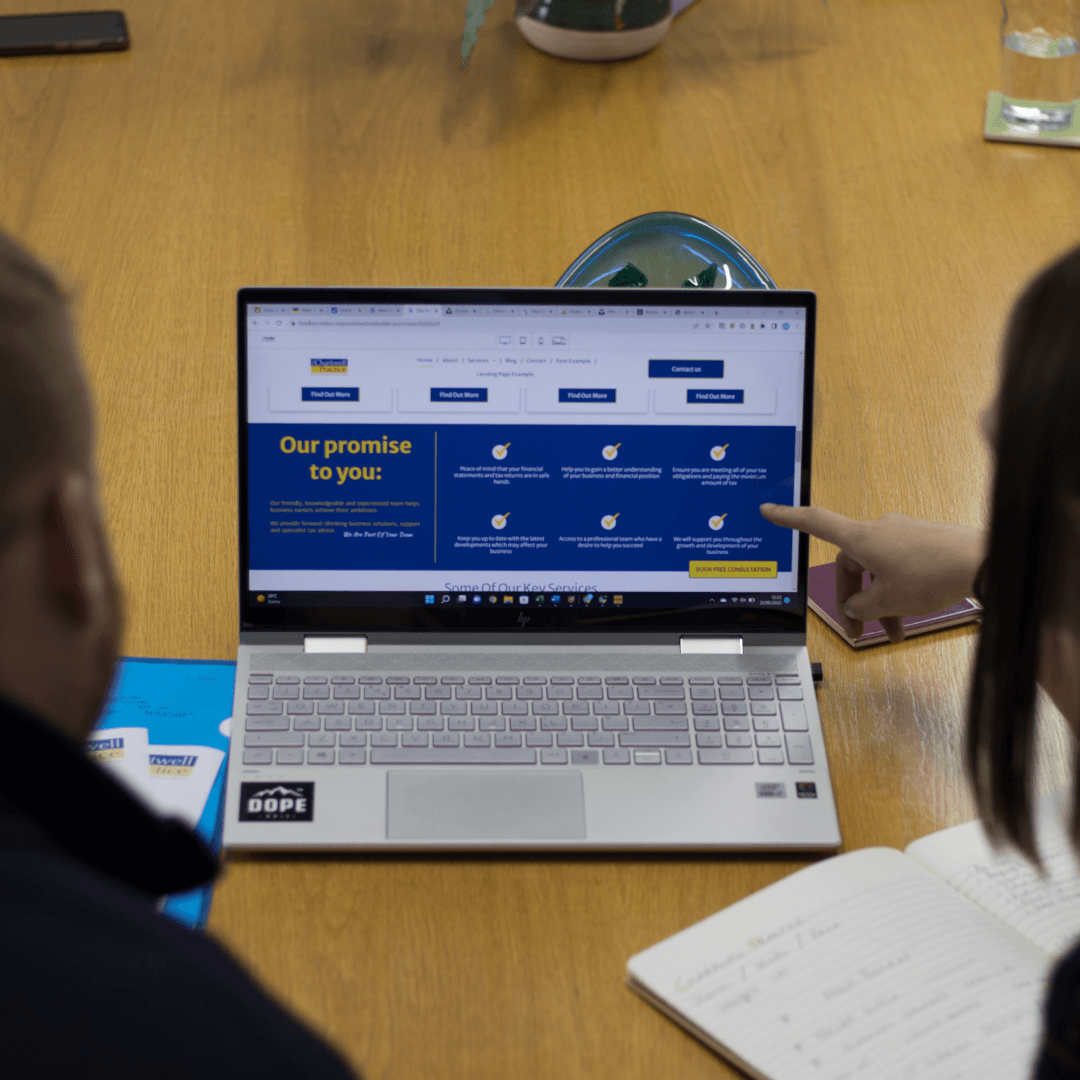

Our promise

to you:

Peace of mind that your financial statements and tax returns are in safe hands

Help you to gain a better understanding of your business and financial position

Ensure you are meeting all of your tax obligations and paying the minimum amount of tax

Keep you up to date with the latest developments which may affect your business

Access to a professional team who have a desire to help you succeed

We will support you throughout the growth and development of your business

Chartwell News