Tax E-News – Budget 2024

On 6 March 2024, Chancellor Jeremy Hunt presented his Spring Budget to Parliament. In the knowledge that the government must hold a general election before 28 January 2025, this was a Budget designed to restore confidence and win voters. But on the heels of Britain entering a recession and downgraded Office for Budget Responsibility (OBR) forecasts, the Chancellor had his work cut out.

Headlines included further cuts in National Insurance Contributions for workers and the self-employed, a slight increase in the VAT registration threshold and an increase in thresholds to reduce the number of people affected by the high-income child benefit charge. There has also been a cut in capital gains tax for higher earners disposing of residential property. However, income tax rates and thresholds remained static and inheritance tax continues to apply to the largest estates.

Below, we talk more about the Budget and what it means for you.

INCOME TAX

Please note that ‘tax years’ run to 5 April each year and that, for example, 2024/25 signifies the year to 5 April 2025.

Your personal allowance

Your tax-free personal allowance will remain at £12,570 in 2024/25. The personal allowance is partially withdrawn if your income is over £100,000 and then fully withdrawn if your income is over £125,140.

Income tax rates and allowances

For 2024/25, income tax rates and thresholds remain frozen at their 2023/24 levels.

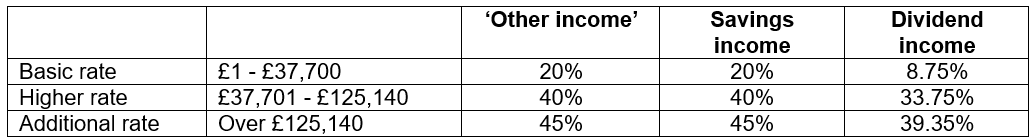

After your tax-free ‘personal allowance’ has been deducted, your remaining income is taxed in bands in 2024/25 as follows.

‘Other income’ means income other than from savings or dividends. This includes salaries, bonuses, profits made by a sole trader or partner in a business, rental income, pension income and anything else that is not exempt.

So what? Without inflationary increases to the income tax bands, the Chancellor is effectively imposing an income tax increase; as wages and earnings rise and a larger proportion falls into higher tax bands. This is known as ‘fiscal drag’.

Scottish taxpayers

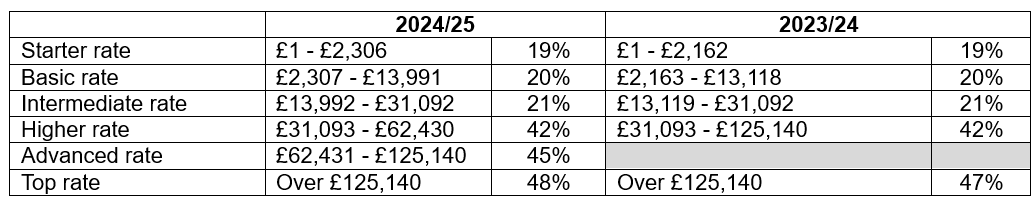

If your main residence is in Scotland or you are otherwise classed as a ‘Scottish taxpayer’, the application of income tax rates and bands applies differently where ‘other income’ is concerned. After the ‘personal allowance’ has been deducted, your ‘other income’ is taxed in bands as follows:

The Scottish Budget was held on 19 December 2023 and made changes including the introduction of the new ‘advanced rate’ of income tax for 2024/25.