Jeremy Hunt's Autumn Statement

Anna Stubbs • November 21, 2022

Jeremy Hunt's Autumn statement - 2022

In his opening remarks, Jeremy Hunt said his priorities are stability, growth and public services.

- Stability

- Stability is about reassuring the market. The Chancellor announced the following new, ‘fiscal rules’ that public sector debt must be falling as a percentage of GDP by the end of a rolling 5 year period, and net public sector borrowings must be below 3% of GDP at the same point in time. These are forecast to be met by year 4.

- Growth

- The main growth measures appear to be extra spending on schools of £2.3 billion in each of 2023/24 and 2024/25, public spending on R&D rising to £20 billion by 2024/25, and infrastructure spending, where Northern Powerhouse Rail, HS2 to Manchester and East West Rail survive (rumours were that these may have been cut). The Chancellor announced a plan is to have 85% of the country able to access gigabit-speed broadband by 2025, with nationwide coverage by 2030. The other growth measure is to ease rules regarding riskier investments, so they can invest in more, for example, in green energy and infrastructure projects.

- Public Services - Planned spending on public services is broadly as already planned up to 2024/25, except for extra spending on education, health and social care. Thereafter, spending will increase by 1% per annum for the following three years.

Main tax measures

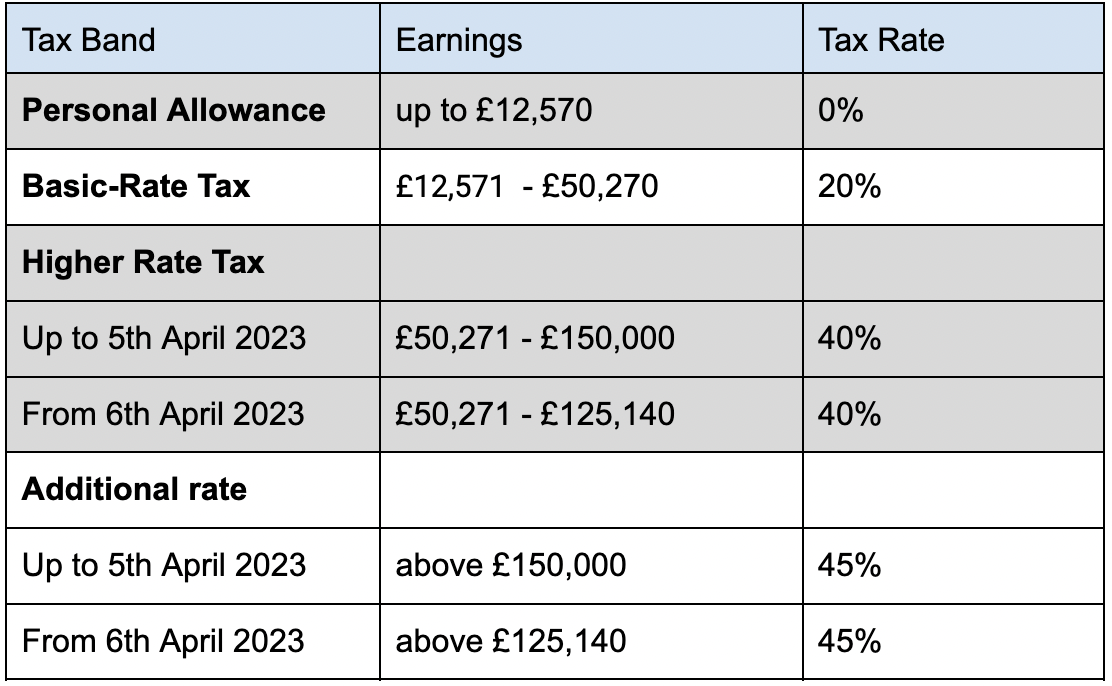

- Income Tax Thresholds - From April 2023 the additional rate (45%) band applies from income over £125,140 (previously £150,000). The tax rates and brackets remain unchanged except that from April 2023 the additional rate of 45% is charged on annual income in excess of £125,140 (currently £150,000). Accordingly, the higher rate of 40% applies on income between £50271 and £125,140 whilst the basic rate is charged on income between £12,571 and £50,270. Personal allowances remain at £12,570. These bands will be fixed until April 2028. Freezing the bands in this way is a so-called ‘stealth tax’, because an increasing proportion of people’s income is taxed over time, and potentially in higher tax bands, due to wage inflation.

The table below shows the tax bands.

- National Insurance Thresholds - The current Lower Earnings Limit (£6,396) and Small Profits Threshold (£6,725) will be unchanged for 2023/24. The Secondary Threshold, the level at which employers start to pay national insurance) will be fixed at the current £9,100 per annum until April 2028. The Upper Secondary Threshold (where the rate paid by employees drops) will be fixed at the current £50,270 until April 2028.

- Inheritance Tax Threshold - Frozen at current levels for a further 2 years to 2028. The tax free threshold is £325,000 and residence nil rate band is £175,000

- Capital Gains Tax Thresholds - Currently the first £12,300 is free of CGT. That will drop to £6,000 from April 2023 and £3,000 from April 2024

- Dividends Tax Thresholds -Currently the first £2,000 is free of tax. That will drop to £1,000 from April 2023 and £500 from April 2024

- National insurance - The Class 2 rate (flat rate for self-employed people) will increase from £3.15 to £3.45 per week from April 2023. The Class 3 (voluntary contributions) rate will increase at the same time to £17.45 from £15.85. These increases are in line with inflation.

- Research and Development - From April 2023, the uplift of R&D expenditure in the small and medium enterprises scheme will be reduced from 130% to 86%, and the payable credit rate will fall from 14.5% to 10%.

- Windfall taxes - The Energy Profit Levy on UK oil and gas profits will increase from 25% to 35% from 1st January 2023, and end on 31st March 2028. A new Electricity Generator Levy of 45% will extend the scope of windfall taxes to include excessive revenue received by electricity generators from January 2023.

- Company Cars - The benefit-in-kind rate for electric and ultra-low emission cars emitting less than 75g of CO2/km will increase by 1 percentage point annually from 2025/26 to 2027/28, at which stage the rate will be a maximum of 5% for electric cars and 21% for ultra-low emission cars. The rate for all other vehicles will be increased by 1 percentage point for 2025/26 and fixed until April 2028.

- Business Rates - There is a range of measures to support business with business rates. Businesses in the retail, hospitality and leisure sector will be entitled to relief of 75% of their rates bills. Measures will also be taken to limit the cost of increases arising from the 2023 revaluation and to ease the impact of Small Business Rates Relief and Rural Rates Relief where those reliefs are lost as a result of the valuation.

Other Measures

- Benefits - Benefits will increase by 10.1% from April 2023. This is in line with inflation. There were some suggestions that the increase should be around 5%, in line with average earnings growth.

- State Pensions - State Pensions will be increased by 10.1%,in line with inflation, thus restoring the triple lock which was suspended previously.

- Energy cost savings - The cap on unit rates for domestic consumers will increase from April 2023 so that average user will be charged £3,000 (currently £2,500/annum) until March 2024. The scheme for non-domestic users expires from April 2023 and a review is being undertaken into further support thereafter, which will exclude public sector consumers and is expected to be at a ‘significantly lower scale’ for business users.

- Cost of Living payments - Pensioner households will receive £300 in 2023/24, presumably paid with the Winter Fuel Allowance. People on means-tested benefits will receive £900 and people on disability benefits £150 in 2023/24.

- National Living Wage - The rate for individuals aged 23 and over will increase by 9.7% to £10.42/hour from £9.50, with similar-scale increases for other categories of worker.

- Stamp duty - The £125,000 increase in the nil stamp duty land tax band and to the higher threshold for first-time buyers is no longer a permanent change. It will be reversed after 31st March 2025.

- Council tax - The maximum that councils can increase council tax by without a local referendum is now 5%, up from 3%.

- ATED - The annual tax on enclosed dwellings charges (a levy on certain residential property held in structures such as companies) will increase by 10.1% from April 2023 in line with inflation.

If you’d like to talk to us about any concerns related to the main announcements, please do get in touch. We’ll be happy to help you start planning a 2023 strategy to overcome your biggest business challenges.

Having adequate access to adequate funding is fundamental for any startup. In the early stages of getting your enterprise off the ground, you need working capital to reach the all-important minimum viable product (MVP) stage, rent premises and hire staff. But where does this initial funding come from? Let’s look at the UK Government's Start Up Loan scheme and the funding options it offers.

Question: “Can cost-saving measures in the business truly be a key driver of profits?” Running a profitable business is one of your key goals as an owner. Without profits, there’s no capital to reinvest in the business, no funds to grow the company and no money for your own dividend payment at the end of the financial year. So, is cost-saving the answer in these challenging economic times? Answer: “Careful management of costs is a fundamental way to improve your profit margins and profitability as an enterprise” Cost-saving measures will have a direct and measurable impact on your profits. This is usually achieved via two main mechanisms. Firstly, reducing your variable costs (like raw materials or direct labour) increases your gross profit margin. This retains more revenue from each sale you make as a business. Secondly, lowering fixed overheads (such as rent or software licenses) directly reduces the total expenses on your profit and loss statement, leading to a higher net profit. This immediate bottom-line improvement makes you a more financially healthy prospect to investors and lenders – which, in turn, can often make it easier to access funding and grow the business. Want to know more about cost-saving measures? Talk to the team about your profit goals and we’ll advise you on the key ways you can reduce your overheads and expenses to drive improved profits.

We all hope that our pathway along the business journey will be smooth and uncomplicated. But the reality is that accidents can happen, along with unplanned injuries, damaging weather events and legal suits from disgruntled clients. So, what can you do to protect your business from these potential negative consequences? The answer is to take out the relevant business insurance for your company.